Tariffs have long defined the boundaries between protectionism and global trade for the United States. This report explores their evolving role, focusing on the 1930 Smoot-Hawley Tariff Act and President Trump’s recently announced “Liberation Day” tariffs. With primary-source data and historical analysis, we examine how past and present tariffs have shaped economic conditions, triggered international retaliation, and tested America’s leadership in global commerce.

A Historical Perspective: The Smoot-Hawley Tariff Act of 1930

Passed on June 17, 1930, the Smoot-Hawley Tariff Act aimed to protect U.S. agriculture and manufacturing during the onset of the Great Depression. It imposed steep duties on over 20,000 imported goods, marking one of the most protectionist moves in American history. However, the policy backfired spectacularly.

Rather than shielding the economy, Smoot-Hawley triggered a wave of retaliatory tariffs by America’s trading partners. U.S. exports fell from $5.2 billion in 1929 to just $1.7 billion by 1933, and imports dropped similarly. This contributed significantly to the deepening of the Great Depression, pushing unemployment from 8% in 1930 to 25% by 1933.

The act’s legacy has become a cautionary tale for protectionist policies, cited often in discussions of trade wars and economic nationalism.

📘 Primary Source: U.S. Senate History of Smoot-Hawley Tariff (June 13, 1930, Eastern Time)

The Trump Era: 2025’s “Liberation Day” Tariffs

On April 2, 2025, President Donald Trump announced sweeping new tariffs as part of a campaign-branded "Liberation Day." These include:

- A universal 10% tariff on all imports.

- Country-specific “reciprocal” tariffs, including:

- China: +34%

- EU: +20%

- Japan: +24%

- India: +26%

- Taiwan: +32%

- A 25% tariff on foreign-made automobiles.

These tariffs are scheduled in two phases: the blanket 10% tariff began April 5, and the higher “reciprocal” tariffs on April 9.

The administration has framed these measures as a push to restore economic independence and correct what it calls "decades of lopsided trade."

📘 Primary Source: AP News – Trump Tariff Announcement (April 2, 2025, Eastern Time)

Economic and Global Trade Impacts

The economic outlook is mixed, with many analysts warning of dire consequences. Citibank and other financial institutions project the average tariff burden could rise to 20%, increasing inflation and potentially driving the U.S. into stagflation—a toxic mix of economic stagnation and rising prices.

Domestic industries warn of disrupted supply chains and higher consumer prices, while labor unions have cautiously praised the policy for its potential to revive U.S. manufacturing jobs.

The international response has been swift. Canada has announced $30 billion in retaliatory tariffs, with its government warning of a potential recession and mass layoffs. The EU and China are also considering reciprocal trade barriers.

U.S. equity markets dipped sharply after the announcement, with Nasdaq futures falling more than 2% on April 2.

📘 Primary Sources:

- Business Insider – Economic Risks of Liberation Day Tariffs (April 2, 2025, Eastern Time)

- Reuters – Global Leaders React (April 2, 2025, Eastern Time)

- New York Post – Canada’s Economic Fallout (April 2, 2025, Eastern Time)

Comparing the Two Eras

| Feature | Smoot-Hawley (1930) | Liberation Day (2025) |

|---|---|---|

| Goal | Protect domestic producers during the Depression | Regain trade balance & revive manufacturing |

| Scope | 20,000+ goods | All imports + targeted countries |

| Global Reaction | Retaliation, collapse in global trade | Retaliation, potential modern trade war |

| Result | Worsened Great Depression | Risk of stagflation and global economic tension |

While separated by nearly a century, both tariff regimes reflect similar nationalist motivations, and both face criticism for inciting retaliation and risking broader economic instability.

Why the 'Trade Deficit ÷ Exports' Formula Doesn’t Justify Tariffs

A circulating theory online attempts to explain the logic behind the "Liberation Day" reciprocal tariffs by suggesting the tariff percentage is based on the U.S. trade deficit with a country divided by that country’s exports to the U.S. On the surface, this may seem mathematically coherent:

Example:

- European Union (EU):

- U.S. imports: $531.6B

- U.S. exports: $333.4B

- Trade deficit: $198.2B

- 198.2 / 531.6 = ~37%, close to the 39% tariff listed.

- Israel:

- Exports: $22.2B

- Imports: $14.8B

- Trade deficit: $7.4B

- 7.4 / 22.2 = ~33%, similar to Israel’s 33% tariff.

Why This Logic Falls Apart:

- Trade Deficit ≠ Unfairness or Barrier Justification

Trade deficits reflect economic behavior, not necessarily exploitation or barriers. A country buying more from the U.S. than it sells to the U.S. could still have fair practices. - Ignores Actual Trade Barriers

The Trump administration’s justification centered on foreign tariffs, subsidies, and non-tariff barriers—not trade imbalance ratios. Using only export/import math omits real-world practices like quotas or currency manipulation. - Fails with Countries With Small Deficits or Surpluses

Some nations with no notable deficit (or even surpluses) are penalized at high tariff rates. For example:- Lesotho: 99% tariff

- Vietnam: 90% tariff

These don’t align with any public formula.

- No Policy Framework or Disclosure

There is no formal acknowledgment or documentation that this ratio is being used in USTR, Department of Commerce, or Executive Order documents—making it speculative at best. - Political Discretion is Likely

Certain allies with equal or higher trade barriers (e.g., U.K., Colombia, Australia) are assessed just 10%, suggesting political factors—not formulae—drive the numbers.

In short: The “deficit ÷ exports” ratio is not a rational or consistent foundation for reciprocal tariffs. It oversimplifies international economics and ignores the legal, political, and institutional mechanisms used in actual trade enforcement.

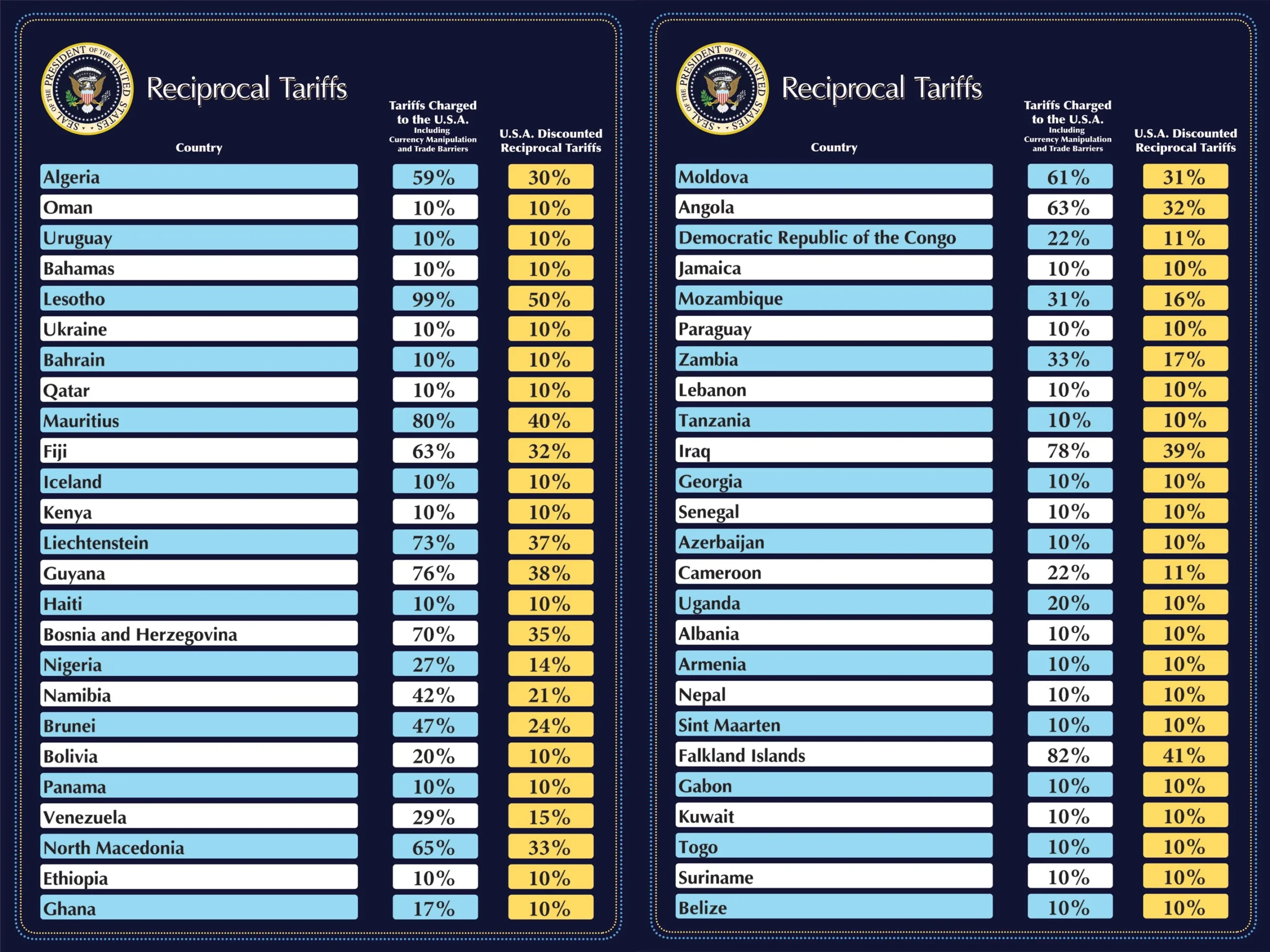

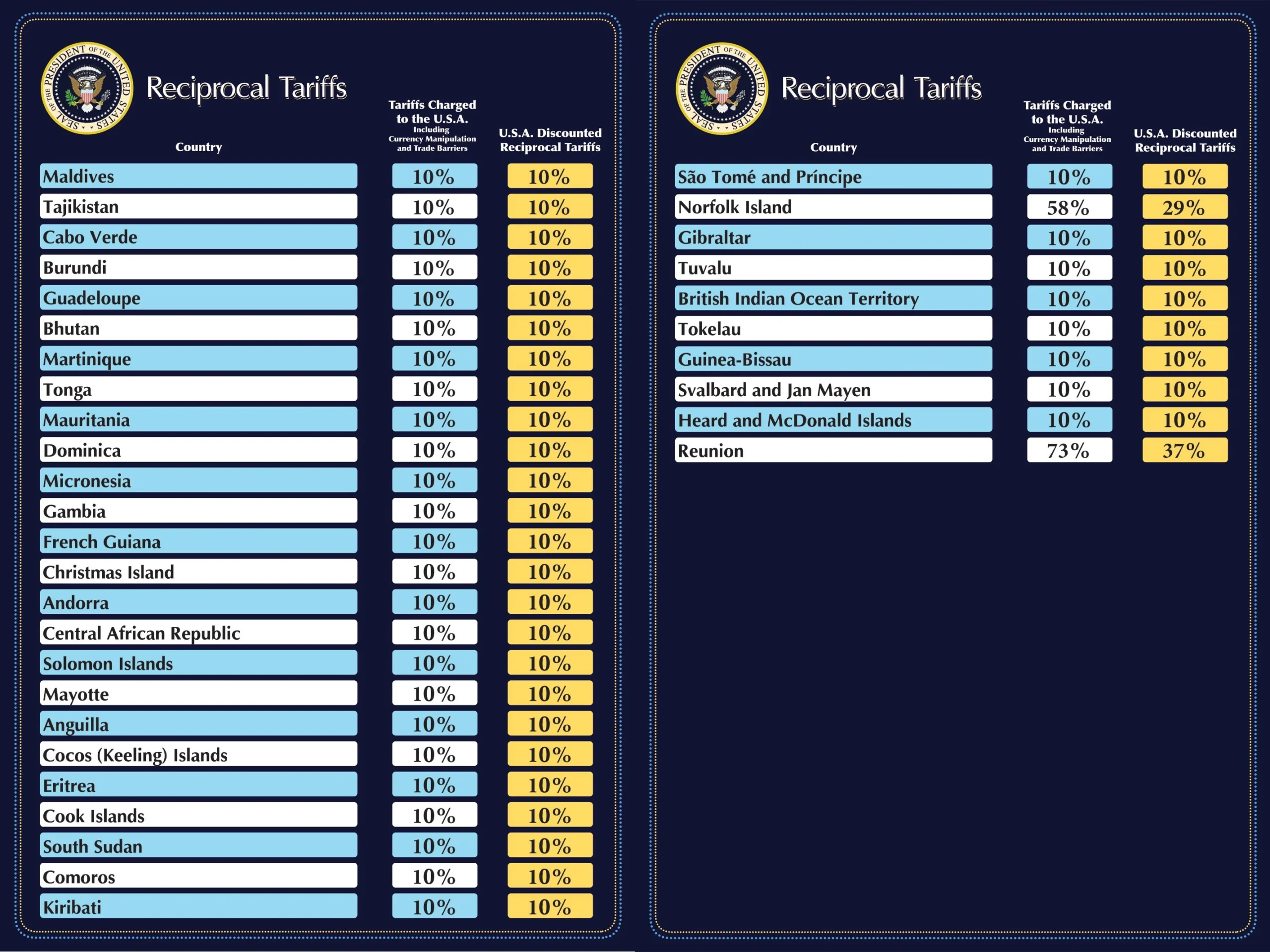

Please find the specific tariff increases announced today per country:

🔹 Bibliography (with Eastern Time publication data):

- “Senate Passes Smoot-Hawley Tariff.” U.S. Senate – June 13, 1930

- “Trump announces sweeping new tariffs.” AP News – April 2, 2025

- “Stagflation risk rises under Trump tariffs.” Business Insider – April 2, 2025

- “World reacts to Liberation Day tariffs.” Reuters – April 2, 2025

- “Canada braces for job losses over tariffs.” NY Post – April 2, 2025